What Is Cost Per Unit: How to Calculate + Tips To Reduce in 2024

Streamlining logistics operations, reducing inventory holding costs, and minimizing time to market can all help reduce cost per unit. Streamlining logistics operations can help reduce cost per unit by reducing the amount of time and money it takes to get products from the manufacturer to the customer. Reducing inventory holding costs can be done by optimizing the inventory levels and selling off excess inventory. The total production cost is found by adding up the total fixed cost and the total variable cost. This formula can be utilized to find the cost per unit for any given product. Variable costs, on the other hand, are expenses that change as production or sales increase.

- A method to lower these costs is by leveraging eLogii to optimize delivery routes.

- Since the total cost of producing 40 haircuts is $320, the average total cost for producing each of 40 haircuts is $320/40, or $8 per haircut.

- On the other hand, price per unit is the amount a customer pays to buy that product.

- Calculating cost per unit is important because it is a key determinant of net profit per unit or earnings per share (EPS).

- Thus, the marginal cost for each of those marginal 20 units will be 80/20, or $4 per haircut.

Cut material costs

- A low per-unit cost is an indicator of efficient production and logistics, which ensures profit is being made per sale.

- For example, as the number of barbers rises from two to three, the marginal product is only 20; and as the number rises from three to four, the marginal product is only 12.

- These businesses have the responsibility of recording unit costs at the time of production and matching them to revenues through revenue recognition.

- Led by Mohammad Ali (15+ years in inventory management software), the Cash Flow Inventory Content Team empowers SMBs with clear financial strategies.

- Connect with our sales team to learn more about our commitment to quality, service, and tech-forward fulfillment.

- Moving forward, the next section draws a comparison between the cost per unit and price per unit.

If you know what sales volumes to anticipate, you can manage your inventory accordingly to reduce costs. Rather than renting a warehouse and hiring/managing a staff, you can store inventory in multiple fulfillment center locations within our network and track storage costs through the ShipBob dashboard. Calculating cost per unit is also important, because it gives ecommerce companies an idea of how much they should charge for each of their products to be profitable. In February 2022, the variable cost incurred was $3,000, which includes raw materials, electricity, and labor.

Calculating and Minimizing Inventory Holding Costs

For example, as quantity produced increases from 40 to 60 haircuts, total costs rise by 400 – 320, or 80. Thus, the marginal cost for each of those marginal 20 units will be 80/20, or $4 per haircut. The marginal cost curve is generally upward-sloping, because diminishing marginal returns implies that additional units are more costly to produce.

How to Calculate Cost per Unit in Excel: Step-by-Step Procedure

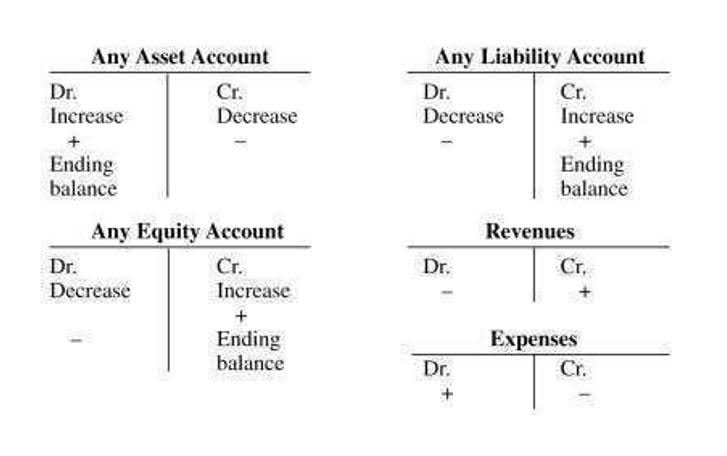

The first five columns of Table 7.10 duplicate the previous table, but the last three columns show average total costs, average variable costs, and marginal costs. These new measures analyze costs on a per-unit (rather than a total) basis and are reflected in the curves in Figure 7.8. The average variable cost, or “variable cost per unit,” equals the total variable costs incurred by a company divided by the total output (i.e. the number of units produced).

Knowing the cost of production will let you make a well-informed decision about the markup value. By adopting effective customer management practices, you can ensure timely order fulfillment and enhance customer satisfaction with their purchases. This practice helps reduce carrying costs related to excess inventory. These costs include expenses for storage, insurance, and material handling.

How Do Variable Costs Impact Break Even Point?

Using the figures from the previous example, the total cost of producing 40 haircuts is $320. If you graphed both total and average cost on the same axes, how to find cost per unit the average cost would hardly show. Whatever the firm’s quantity of production, total revenue must exceed total costs if it is to earn a profit.

How to Use a Perpetual Inventory System for Your Ecommerce Business

Optimizing the cost per unit through operational efficiency, strategic supplier management, and cost reduction initiatives can lead to improved profitability and a competitive edge in the market. Direct calculation works for businesses with a straightforward cost structure, and distinguishing fixed and variable costs is easy. For example, a small confectionary owner can easily distinguish between fixed costs like rent and salaries and variable costs such as flour, sugar, and labor. Then, it can divide the total costs by the number of confectionary items produced. Effective inventory management techniques such as proper demand forecasting, Just-In-Time (JIT) inventory management, and RFID technology can all help lower the cost per unit. By maintaining inventory accuracy and accurately forecasting demand, brands can ensure that they have the right amount of inventory on hand to meet customer demand.

- For instance, the cost of producing a smart TV will be higher than that of a shirt.

- Buffers are supplies or products kept in place to deal with demand forecasting or supply chain fluctuations that can arise in the future.

- Smart inventory management practices are indispensable for slashing the cost per unit.

- Don’t get caught with too much capital tied up from storing inventory that isn’t selling.

- The only way to increase or decrease output is by increasing or decreasing the variable inputs.

- Average unit price is the average price an item is sold for in a specific time period.

- To cover costs and achieve a profit, the company needs to set a unit price higher than $21.25.