HOA Reserves on the Balance Sheet

That way, reserve expenditures will be a separate line item on the balance sheet which makes it easier to read, IMO, for the board and the owners. Often, board members try to cover unexpected expenses by imposing a special assessment fee on the association’s members. However, although this may help the board to receive the needed money to cover large-scale fixes and upgrades, there are several reasons why relying on special assessments is a bad idea. However, your savings account is where you hold onto your reserve funds to pay for unexpected expenses, like that new pump for your pool. In addition to reserve funds, an HOA also manages operating funds. Both the reserve and operating funds require homeowners within the HOA to pay fees.

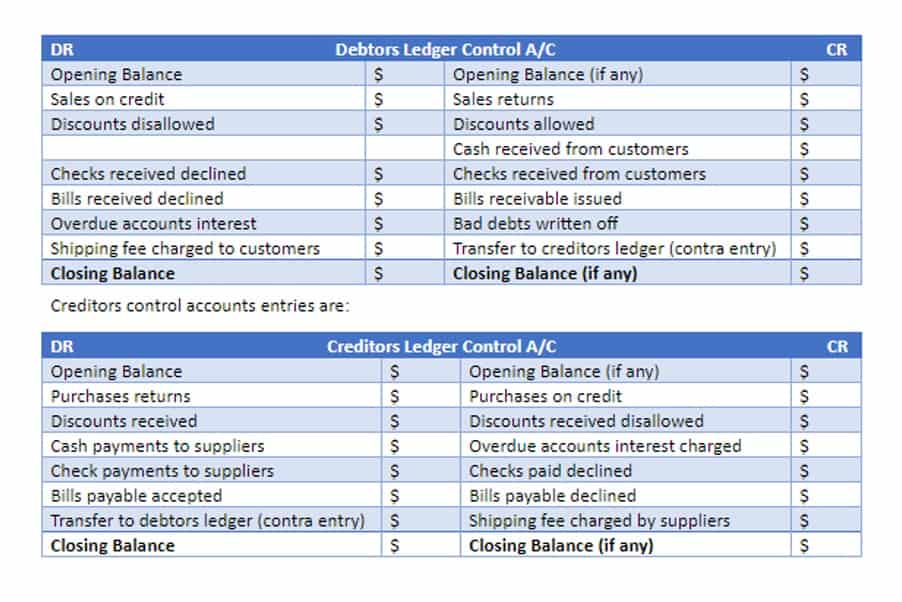

I’ve been treasurer of a couple of HOAs and QB works just fine IMO. The proper way to account for reserves is to record them as income when received and then create a journal entry that debits your Replacement Reserve expense account and credits your Replacement Reserve equity account. That creates the offsetting expense entry on your P&L with a corresponding amount to equity on the balance sheet so those funds can be spent from there when needed. Besides these differences of purpose, it’s important that reserve and operating funds are kept in separate accounts as part of reserve fund accounting. In contrast, a proactive approach to HOA reserve funds involves maintaining assets on a regular basis using the HOA operating fund. Any significant improvements or refurbishments to major assets that extend useful life are paid for using HOA reserve funds.

The Main 3 HOA Reserve Fund Question

In each situation, a third column, called the cash column, is added to the balance sheet. HOAs record money due in the first column and money owed in the second. When the money actually lands in the HOA’s bank account or is paid by the HOA, the entry shifts to the cash column to reflect the true account balance. To conduct a reserve fund study, an HOA can hire an outside firm to come in and inspect the property to determine what’s going to need fixing and upgrading in the near, and even distant, future.

Many won’t even be able to afford increased dues or pay a large amount at one time, as often happens when there is a special assessment. Civil Code Section 5200(a)(3)(d) states that records must follow an accrual or modified accrual basis whenever an HOA member requests copies of the association’s financial records. With the cash basis method, amounts for Accounts Payable, Assessments Receivable, and Prepaid Assessments don’t show up on the association’s Balance Sheet.

Places to Find Your HOA’s Governing Documents

They will then determine how much money the HOA will need to make those repairs. To determine how much money they need for reserve funds and, therefore, what to build into the fees, HOAs must conduct a reserve fund study. Properties whose mortgages fall under FHA, Freddie Mac, or Fannie Mae governance, for example, are only required to have 10 percent of the reserve funded. But if a big repair comes up, the HOA risks having to do a special assessment to cover the cost. A reserve fund is essential for HOAs, as it allows communities to have enough money to cover emergency expenses or unforeseen repairs and renovations.

The annual Reserve Contribution has to be considered when preparing the annual budget because each owner must pay their fair share of the Reserve Contribution as part of their overall annual assessment amount. This should be based on a Reserve Analysis rather than just “winging it”, which means, using a more scientific hoa reserve accounting journal entry approach to determine the amount even though, by its nature, a Reserve Analysis can never be 100% accurate. Reserves are monies set aside for the future replacement or renovation of the major community components such as driveways, parking lots, street lighting, playground, pool, roofs, painting, etc.

How do you account for reserve funds?

For money earned, an HOA would use the accrual method, recording money when it is due to the association and shifting it to the cash column when cash is received. When money is owed by the HOA, expenses are only recorded when the money is actually paid, like the cash accounting method. Since the HOA must also collect operation funds, the monthly fee that residents must pay should include enough money for regular maintenance and services. All homeowners associations have different needs, sizes, expenses, and common elements. Every time a resident pays the monthly HOA fee, a portion goes to the operating fund while another portion, probably smaller, is set aside and kept as part of the reserve fund. Overall, the HOA’s board of directors manages reserve funds, as it’s part of its responsibility to keep properties in good condition and up to the contractual agreements with residents.

The appropriate dollar balance for any given community’s reserve fund depends in large part on the size of the association, the nature of the common elements, and the extent of the HOA’s obligations. Some state HOA and condo laws establish specific reserve requirements, but funding needs are more commonly set by the board in accordance with standards detailed in the association’s governing documents. A reserve account is “fully funded” if it covers 100% of the community’s reasonably foreseeable expenses. Many communities choose to set reserve requirements at a percentage of anticipated expenses, as estimated by the board or identified in a reserve study.